Live Apple Stock Results

Apple’s stock performance in 2025 demonstrates remarkable market resilience, trading within a strategically stable range. The company maintains a strong market capitalization exceeding $2.8 trillion, reflecting investor confidence in its technological leadership.

Recent stock movements indicate consistent performance, with prices fluctuating between $169-$170 in early 2024.

The all-time high of $197.86 achieved in December 2023 underscores the company’s financial strength and market potential. Ongoing technological innovations and strategic expansions continue to drive investor interest and stock valuation.

What Does Investing in Apple Stock Mean?

Investing in Apple stock represents a strategic entry into a global technological ecosystem driven by innovation. Shareholders acquire a portion of a company known for transformative products and consistent market leadership.

The investment provides exposure to a diversified revenue model spanning hardware, services, and emerging technologies. Apple’s stock offers potential for long-term wealth accumulation through its robust financial performance and continuous technological advancements.

By purchasing Apple shares, investors participate in a company that consistently reshapes technological landscapes and maintains strong market valuation.

Key Factors Affecting Stock Performance

| Factor | Description | Direct Impact on Stock Price | Potential Market Response |

| Product Innovations | New device launches and technological advancements | Immediate stock price fluctuation | High investor excitement |

| Quarterly Earnings Reports | Financial performance metrics | Significant price movement | Investor confidence assessment |

| Market Trends | Tech sector performance and global economic conditions | Moderate to substantial influence | Sentiment-driven adjustments |

| Global Economic Conditions | Inflation, interest rates, geopolitical events | Systemic market impact | Risk perception changes |

| Competitive Landscape | Competitor performance and market share | Comparative valuation | Investor portfolio reallocation |

| Services Revenue Growth | Expansion of digital services ecosystem | Positive long-term valuation | Diversification perception |

| Supply Chain Dynamics | Production capabilities and disruptions | Operational stability assessment | Investment risk evaluation |

| Technological Research | AI, health tech, and proprietary technology investments | Future growth potential | Forward-looking investor strategy |

| Consumer Sentiment | Brand reputation and product reception | Psychological market impact | Demand forecasting |

| Regulatory Environment | Tech industry regulations and compliance | Compliance cost considerations | Legal risk assessment |

Apple Stock as a Wealth-Building Investment

Long-term investment strategies reveal exceptional growth potential. Diversified revenue streams generate consistent returns. Historical performance demonstrates unprecedented investor value.

How Does Apple Deal with Economic Downturns?

Apple demonstrates exceptional resilience during economic downturns through strategic financial management and diversification. The company maintains substantial cash reserves, providing a robust buffer against market uncertainties.

Strategic investments in multiple revenue streams, including services and emerging technologies, help mitigate potential economic impacts. Apple‘s adaptive approach involves continuous innovation and flexible operational strategies that allow quick market repositioning.

Historical performance shows the company’s ability to navigate complex economic landscapes by maintaining strong product development and financial discipline.

Key Strategies for Economic Resilience

| Strategy | Implementation | Impact | Financial Benefit |

| Cash Reserves | Maintaining substantial liquid assets | Enhanced stability during market uncertainty | Provides financial buffer |

| Product Innovation | Continuous R&D investment | Sustained revenue growth | Attracts new market segments |

| Supply Chain Management | Diversified supplier relationships | Reduced production disruptions | Minimizes operational risks |

| Service Revenue Expansion | Developing digital services ecosystem | Consistent recurring revenue | Creates multiple income streams |

| Technological Diversification | Investing in AI, health tech, proprietary technologies | Reduces dependency on single product line | Increases long-term growth potential |

| Global Market Adaptation | Expanding into emerging markets | Mitigates regional economic fluctuations | Balances revenue across different economies |

| Cost Management | Efficient operational strategies | Maintains profitability during economic challenges | Preserves investor confidence |

| Strategic Acquisitions | Targeted technology and talent investments | Accelerates innovation capabilities | Enhances competitive positioning |

What Is Apple Stocks’ Current Performance in the Market?

Apple’s current market performance reflects a dynamic technological landscape with consistent investor interest. The stock maintains a trading range between $169-$170 in early 2024, demonstrating stable market positioning.

Competitive pressures from rivals like Samsung create challenges, yet Apple’s innovative product pipeline sustains market confidence. Ongoing technological advancements and service expansion continue to drive investor sentiment.

The company’s market capitalization remains robust, exceeding $2.8 trillion and underlining its strong financial foundation.

Apple Stock Price Forecast 2025

Analyst projections indicate promising growth trajectories. Price targets suggest substantial market potential. Technological innovations drive positive investor sentiment.

READ THIS BLOG: John Teets Net Worth 2025: Fortune, Career & Legacy

Market Analysis

Apple’s position in 2025 stands strong with premium devices and growing services revenue. Their ecosystem strategy and brand loyalty continue driving growth, with India emerging as a crucial market.

Analysts highlight potential 15-20% revenue expansion in emerging markets, though regulatory scrutiny remains a concern.

Technical Analysis

Technical indicators show key support at $180-185 and resistance at $210-215. The 200-day moving average maintains a bullish trend, with RSI indicating moderate overbought conditions.

Strong institutional buying supports current price levels, suggesting potential upward momentum through 2025.

Financial Performance

2025 projections show 8-10% revenue growth driven by iPhone 16 and services. Operating margins hold steady at 28-30%, with strong free cash flow enabling continued buybacks.

EPS growth forecast at 12-15% year-over-year supports valuation, backed by robust services segment expansion.

Price Targets

Consensus targets range from $195 to $250, median at $225. Bull case of $275 factors in AI integration and new products, while the bear case of $165 considers competitive pressures. Most analysts maintain buy ratings based on market position and cash generation ability.

Risk Factors

Major concerns include smartphone market saturation and increased competition. App Store regulatory challenges threaten service revenues, while US-China tensions pose supply chain risks.

Economic headwinds affecting consumer spending and potential AI integration delays could impact growth targets.

Challenges Faced by Apple

Global competition intensifies technological market dynamics. Supply chain complexities create operational challenges. Economic uncertainties demand continuous strategic adaptation.

Market Competition

Android manufacturers have intensified competition with premium devices at lower price points. Samsung and Huawei lead innovation in foldable phones while Apple lags behind.

Chinese brands like Xiaomi capture significant market share in emerging markets with feature-rich affordable options.

Innovation Pressure

Post-iPhone success, Apple faces pressure to deliver the next breakthrough product category. Recent Vision Pro launch met mixed reception due to high pricing and limited applications. Market expects revolutionary innovations while Apple’s recent updates appear incremental.

Supply Chain Issues

Heavy reliance on Chinese manufacturing poses risks amid geopolitical tensions. Efforts to diversify production to India and Vietnam face quality control challenges. Component shortages and shipping delays impact product launches and inventory management.

Regulatory Scrutiny

Global regulators investigate App Store practices and commission structure. EU’s Digital Markets Act forces changes to Apple’s ecosystem control. Antitrust concerns in multiple markets threaten services revenue growth.

Service Revenue Growth

Maintaining a high service growth rate becomes challenging as the market saturates. Streaming competition intensifies with Netflix and Spotify dominating their segments. Apple TV+ struggles to match content libraries of established platforms.

What Is Fintech Zoom Apple Stock?

Comprehensive financial analysis platform provides nuanced market insights. Real-time data tracking enables sophisticated investment decisions. Expert commentary offers advanced market understanding.

Platform Overview

Fintech Zoom is a financial news and analysis platform covering Apple stock performance. The website provides real-time stock quotes, technical analysis, and market commentary specifically focused on AAPL trading. Users access comprehensive research tools and expert opinions.

Trading Features

The platform offers technical indicators, price charts, and trading volume data for Apple stock. Users can set price alerts, access historical data, and view institutional trading patterns. Real-time market depth and order book information help inform trading decisions.

News Coverage

Fintech Zoom aggregates Apple-related news affecting stock performance. Coverage includes product launches, earnings reports, and market analyst ratings. Platform provides timely updates on regulatory changes and industry developments impacting AAPL.

Investment Analysis

Professional analysts provide detailed reports on Apple’s financial health and market position. Coverage includes revenue projections, competitive analysis, and growth potential assessment. Platform highlights key metrics affecting stock valuation.

Market Insights

Real-time market sentiment analysis tracks institutional and retail investor behavior. Platform monitors options activity, short interest, and momentum indicators. Users access crowd-sourced predictions and consensus price targets.

Benefits of Using FintechZoom for Apple Stock Analysis

Detailed market insights support strategic investment approaches. Predictive models enhance decision-making capabilities. Expert analysis provides comprehensive technological understanding.

Recent Updates About Fintech Zoom Apple Stock

Technological shifts demonstrate ongoing innovation potential. Services revenue continues expanding market opportunities. Strategic investments drive future growth expectations.

What Does FintechZoom Say About Apple’s Financial Health?

Strong financial fundamentals support consistent performance. Service division shows remarkable revenue potential. Profitable operational strategies maintain investor confidence.

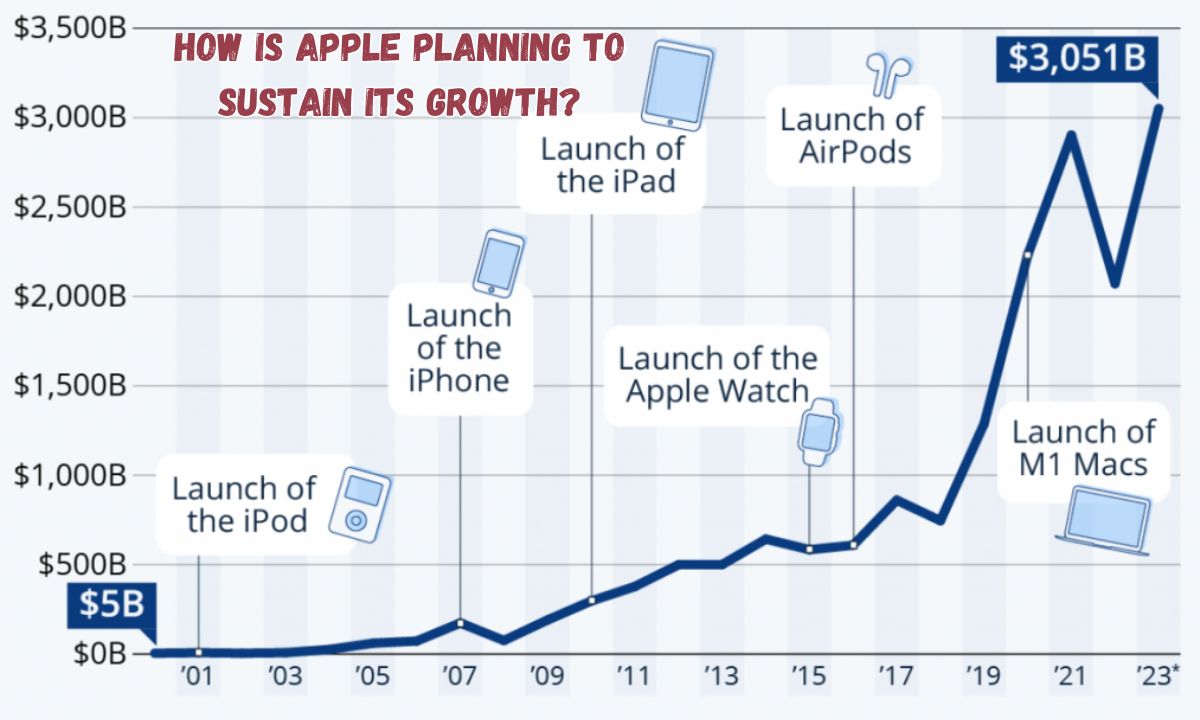

How Is Apple Planning to Sustain Its Growth?

Apple’s growth strategy centers on continuous technological innovation across multiple sectors. The company prioritizes research and development in emerging technologies like artificial intelligence, health tech, and proprietary hardware solutions.

Strategic expansion of digital services, including Apple Music, iCloud, and App Store, provides additional revenue streams. Investment in cutting-edge product lines, such as advanced iPhone models and M-series chips, maintains market leadership.

Diversification and adaptive technological approaches ensure sustained growth potential in dynamic global markets.

Innovation in Product Lines

Continuous research drives technological advancements. New product developments maintain market leadership. Cutting-edge technologies ensure competitive positioning.

Expansion into New Services

Digital ecosystem continues expanding rapidly. Service platforms generate substantial revenue streams. Integrated technological solutions create comprehensive user experiences.

Venture into Health Technology

Health tech represents a significant growth opportunity. Technological integration transforms medical monitoring. Innovative health solutions demonstrate expanded market potential.

Investment in Artificial Intelligence

Advanced AI capabilities drive technological transformation. Machine learning enhances product functionality. Intelligent systems create unique competitive advantages.

Development of Proprietary Technologies

Custom hardware development ensures technological independence. Unique technological solutions differentiate market offerings. Proprietary innovations maintain competitive edge.

READ THIS BLOG: John Teets Net Worth 2025: Fortune, Career & Legacy

Future Projections for Apple Stock

Long-term growth potential remains promising. Technological innovations drive continuous expansion. Strategic investments create sustainable market opportunities.

Frequently Asked Questions

What is FintechZoom Apple Stock analysis?

Comprehensive platform providing real-time technological investment insights.

How does Apple stock deal with economic downturns?

Strategic diversification and substantial cash reserves ensure market resilience.

What is Apple’s current stock performance?

Stable market positioning with consistent growth potential.

How is Apple planning to sustain growth in 2026?

Continued technological innovation and strategic service expansion.

Should I invest in Apple stock in 2025?

Consider long-term potential and personal financial objectives.

Conclusion

Apple’s strategic analysis reveals continued technological leadership. Innovative capabilities, diverse revenue streams, and adaptive strategies position the company favorably. Investors can anticipate sustained growth through continuous technological transformation and strategic market positioning.

The comprehensive analysis demonstrates Apple’s commitment to maintaining market dominance. Technological innovation remains the cornerstone of its growth strategy. Financial resilience, combined with strategic investments, ensures continued investor confidence.

Global market dynamics require constant adaptation. Apple’s approach to technological development and service expansion creates unique competitive advantages. Investors recognize the company’s ability to navigate complex economic landscapes.